|

There are some important changes to superannuation regulations that will be rolled out over the next 12 months. Some of these have been expected for some time and others were announced in last month’s federal budget.

We’ll discuss the changes that will have an impact on your financial plan directly and through the normal review process to ensure that you’re taking advantage of the opportunities that are relevant to you, however as it’s difficult to keep track of all changes we’ve summarised the key issues and impacts below. As always, please contact me with any queries or for more information. The table provides a high level summary with more detail below: There was a press release from the Prime Minister's office over the weekend that with everything happening at the moment hasn't received much airplay, but which has the potential to impact your superannuation pension requirements for the forthcoming financial year.

As you'll be aware regulations require that the recipients of a superannuation pension draw at least a minimum level of income each year. The minimum depends upon the age of the recipient and is calculated as a percentage of the balance of their account at the start of the financial year. For example, a superannuation pension recipient aged between 65 and 74 is normally required to draw a minimum of 5% of their account balance each financial year. The 2021/22 budget was handed down by federal government last night. As was the case with the delayed (COVID) 2020/21 budget, the focus is expansionary to pump money into the economy.

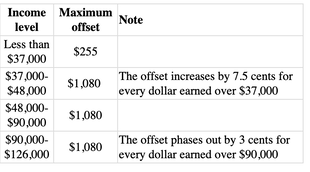

Below is an overview of the key issues that we expect will most impact financial plans and strategy in the future. This isn't a complete list of all the initiatives that were announced so if you require further detail on the information below or on any other matters from the budget announcement then please contact our office and we'll be very happy to provide that detail. The key initiatives are: Personal taxation: Low and Middle Income Tax Offset (LMITO): This offset was introduced for the current tax year and will be carried over to the 2022 financial year as well (ie: to 30 June 2022). The much anticipated budget was handed down by federal government last night.

As expected the focus is expansionary to pump money into the economy. Below is a brief overview of the key issues that we expect will most impact individuals. Many other initiatives were announced that are targeted specifically at businesses, which we won't detail here but if you would like more information on any business related matters then please contact our office and we'll be very happy to provide that detail. The Federal Government yesterday announced that the JobKeeper and JobSeeker payments will be extended beyond the previously announced end-dates in September 2020.

This is a positive development, although the level of the benefit available and some of the terms applicable to the schemes has changed. This is the link to the government announcement (https://treasury.gov.au/coronavirus?utm_source=ExactTarget&utm_medium=Email&utm_term=6106632&utm_campaign=&utm_content=), which also contains further detail and links to further resources. |

AuthorNext Level Financial Services provides financial information in an easy to read format. Archives

August 2023

Categories

All

|

Our Financial Services Guide Privacy Policy (2020) Complaints ©2023 Next Level Financial Services CALL - 03 9188 4254

RSS Feed

RSS Feed