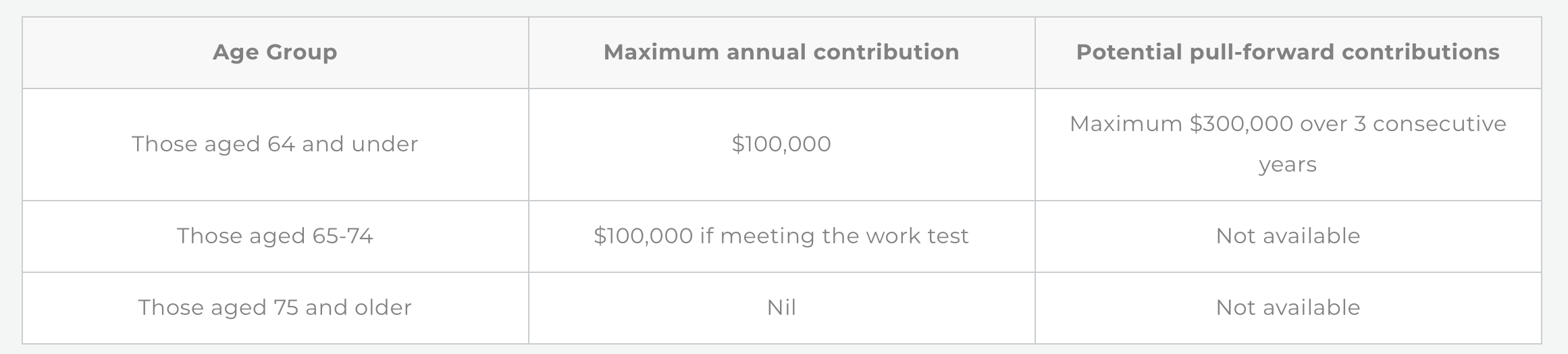

After-tax contributions to superannuation can now be made up to age 67 and the legislation was partially implemented on 1 July 2020. Background: The change in legislation pertains to after-tax contributions to superannuation – these are amounts that can be contributed to superannuation tax-free from accumulated savings, sale of assets etc. It doesn’t include employer contributions, salary sacrifice or tax deductible contributions, all of which are taxed when they reach your superannuation fund. Prior to 30 June 2020 the rules that pertained to after-tax contributions were: Those aged 64 and under could make after-tax contributions of up to $100,000 pa or up to $300,000 over 3 consecutive financial years. The latter refers to a ‘pull forward’ rule allowing the contributor to make a contribution of more than $100,000 in a financial year but then limiting the contributions that they can make over the next 2 financial years to an aggregate amount of no more than $300,000 over 3 consecutive years. For example, if the contributor used the pull forward rule to contribute $250,000 to superannuation in one financial year then they’d be limited to a maximum of $50,000 in additional after-tax contributions over the next 2 financial years. Those aged 65-74 could make post-tax contributions of up to $100,000 pa but only if they met the work test. The work test requires the contributor to have been gainfully employed for a minimum of 40 hours in any consecutive 30 day period in the year in which the contribution is made. Those in this age bracket were limited to after-tax contributions of $100,000 pa (ie: they can’t use the pull forward rule). What changes apply from 1 July 2020?

Hence, from 1 July 2020 the rules pertaining to after-tax contributions are: Age Group Maximum annual contribution Potential pull-forward contributions Those aged 66 and under $100,000 Maximum $300,000 over 3 consecutive years* Those aged 67-74 $100,000 if meeting the work testNot available Those aged 75 and olderNilNot available * Assuming that the legislation to permit those aged 65 and 66 to utilise the pull forward rule passes parliament. Please note:

What impact does this have on your financial plan? The change in regulations provides further flexibility over coming years to ensure individuals have the maximum possible funds within a tax-free environment at retirement. The main advantage will be the extension to the period of time that everyone will be able to get funds into superannuation even if they are not working past age 65. For more information book a complimentary initial appointment with our team. This information is issued by Next Level Financial Services ABN 40 771 964 301, Corporate Authorised Representative No. 461059 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 (AFSL 225051) and is current as at the date of publication. It is not financial product advice and is intended as a guide only. In preparing this information, Next Level Financial Services has relied on publicly available information and sources believed to be reliable. However, the information has not been independently verified by Next Level Financial Services. While due care and attention has been exercised in the preparation of this information, Next Level Financial Services gives no representation or warranty (express or implied) as to its accuracy, completeness or reliability. The information presented is not intended to be a complete statement or summary of the matters referred to. Neither Next Level Financial Services nor their related entities, nor any of their directors, employees or agents accept any liability for any loss or damage arising out of the use of all or part, or any omission, inadequacy or inaccuracy in, the information presented. You may have seen that the previously announced JobKeeper proposal was passed by parliament yesterday.

This is critical as it's possible that many people whose employment/income has been impact by the crisis will benefit more from JobKeeper than from other available stimulus measures. However, unfortunately there remains confusion about how the available support works and what individuals should be applying for. Part of this is because the JobKeeper scheme is named similarly to the JobSeeker scheme, but they refer to different things and apply in different circumstances. Below are some Q&As that I hope will assist those needing information, but please contact our office if you need more detail or guidance. We're also very happy to speak will family members or friends who may require help - we may not be able to give them specific advice, but we can talk with them generally about the assistance available and where they should start. We'll focus on JobKeeper and JobSeeker here but summaries of all stimulus initiatives are attached for reference. What's the difference between JobKeeper and JobSeeker? Both are designed to assist individuals whose income has reduced or has been totally eliminated. However, JobKeeper is a temporary payment made to eligible employers to pass onto their eligible employees, whereas JobSeeker is a benefit directed to the individual. JobKeeper is a temporary stimulus package specifically in response to the coronavirus crisis. It's a benefit paid to employers if their business income has declined by a certain amount (please refer below) with the requirement that the payment be passed onto their eligible employees (also more information below). JobSeeker has been around for a long time - in past lives it's been known as Newstart and the Dole. Usually there are means tests applied such that if the applicant's income or assets (including the income or assets of their partner) are above a certain level then their entitlement will be reduced or eliminated. Those receiving JobSeeker must also meet certain 'mutual obligations' requiring them to complete activities to seek employment. Who qualifies for a JobKeeper benefit and how much can they receive? Qualification for the JobKeeper benefit is dependent upon the revenue of the business in which you were employed on 1 March 2020. A business is eligible for JobKeeper benefits if:

In most cases the measure of the decline in revenue is in comparison with the same month or quarter of 2019. Those businesses that qualify are required to register (https://www.ato.gov.au/general/gen/JobKeeper-payment/) and if approved by the ATO will receive $1,500 per fortnight for every eligible employee for a period of 6 months from 30 March 2020. Eligible employees are those aged at least 16 and employed full time, part time or on a casual basis (but casuals must have been employed for a minimum of 12 months as at 1 March 2020). It doesn't matter if the eligible employee is still employed as normal, is working on reduced hours or has been stood down. However, any employee made redundant since 1 March 2020 will only qualify if subsequently re-employed. The JobKeeper benefit is paid to the employer and must be passed onto each eligible employee in full. Eligible employees whose income is currently higher than $1,500 per fortnight won't likely receive more, however the benefit will subsidise part of their employment cost thus reducing the financial pressure on their employer. Those employees whose income is currently less than $1,500 per fortnight (or nil) will receive the full $1,500 per fortnight benefit. Eligible employees who work for multiple employers can only receive the JobKeeper benefit from one (usually the employer from whom they claim the tax free threshold in their wages). Payments will be made in early May but backdated to 30 March 2020. Who qualifies for a JobSeeker benefit and how much can they receive? JobSeeker benefits depend upon individual circumstances, however in response to the crisis the government is temporarily waiving the usual asset test requirement, has loosened the income test requirement and won't impose the 'mutual obligation' requirement for new applicants for the time being. Generally speaking those who are single and whose income is impacted by the crisis will qualify for a JobSeeker benefit if their current income is less than $28,249 pa, though it could be up to $55,243.50 pa if caring for dependents. Those who are a member of a couple will qualify if their current income is less than $25,831 pa (depending on their partner's income) or if they have no current income and their partner's current income is less than $79,788.80 pa. The amount of the JobSeeker entitlement also depends upon individual circumstances, but is up to $565.70 per fortnight for a single person without dependents and up to $790.10 per fortnight for those with dependents. However, another facet of the current stimulus measures is a $550 per fortnight supplement to the JobSeeker benefit, so for the next 6 months the benefits increase to between $1,115.70 per fortnight and $1,340.10 per fortnight respectively. What about tax and superannuation? Both JobKeeper and JobSeeker payments are taxable income and will need to be declared in your tax return for the financial year in which the benefit is received. Your employer should deduct tax from the JobKeeper benefit if required, but tax isn't usually deducted from JobSeeker benefits (although you can apply to Centrelink to change this). If in doubt please speak with us or with your accountant to ensure that you don't end up with an unexpected tax liability. Neither JobKeeper nor JobSeeker benefits attract superannuation contributions, however you may wish to make superannuation contributions from any JobKeeper benefit that you receive - please speak with your employer to organise this. Should you apply for JobKeeper or should you apply for JobSeeker? The JobKeeper benefit ($1,500/fortnight) is higher than the maximum JobSeeker benefit. Hence, if your employer qualifies for the JobKeeper benefit then my recommendation is to approach them to ensure that they register and to stay in touch with them to follow up the payments. However, if your employer doesn't qualify or if you're unsure then I recommend lodging an application for the JobSeeker benefit with Centrelink. This can be done via MyGov ( go to www.my.gov.au if you don't already have an account) and linking to Centrelink. If you haven't already done this then I recommend doing so ASAP as there's a backlog of applicants and unfortunately the process is detailed. Please contact us if you're having trouble and we'll talk through it. Can you receive JobKeeper and JobSeeker? No. As JobKeeper benefits are treated as taxable income, they count in the income test for the JobSeeker entitlement and will preclude an individual from receiving both. However, as above, if you're unsure whether your employer is going to receive the JobKeeper benefit on your behalf, then I encourage you to apply for JobSeeker as a backup. If you subsequently receive a JobKeeper benefit then you'll need to disclose that to Centrelink and you won't receive JobSeeker, but you'll be no worse off and will have the peace of mind of knowing that you've at least registered for a benefit. What if you don't think that you qualify for either JobKeeper or JobSeeker? Please contact our office and we'll discuss your circumstances. There are other stimulus measures that may be appropriate or at the very least we can talk through strategies to manage your cash flow through the forthcoming period. Download File stimulus_package_-_assistance_for_individuals___households_-_update_1.pdf Download File stimulus_package_-_assistance_for_small_and_medium_businesses__1_.pdf As you'll have likely seen in the press the government has announced some further stimulus measures in addition to those already announced and have also amended a key component for those seeking the JobSeeker allowance (please see below, towards the end of this email).

We've attached the previously announced measures for reference as they remain relevant, but the key additional measure announced yesterday is the JobKeeper Payment. Unfortunately there's a bit of confusion around this so there's some further detail below based on what we know, but please contact our office if you need more information or guidance. The current status of JobKeeper: The below detail has been announced but it yet to pass parliament so there may be further refinements or detail to emerge. What is JobKeeper? It's a business support package with payments to be made to employers, not employees (however the payments must be on-paid to employees). The overall design of the policy is to assist employers in keeping employees on their books. Eligible employers will qualify for a payment of $1,500 per fortnight per employee for a maximum of 6 months. Assuming that the legislation passes parliament, payments will begin from May 2020 but will be backdated to 30 March 2020. Which employers are eligible? Employers become eligible if their business turnover has reduced by more than 30% vs last year (if the business has less than $1 billion in turnover) or has reduced by more than 50% vs last year (if the business has turnover above $1 billion). Employers can be a company, trust or not-for-profit and the indication is that it will also include the self employed and sole traders. If the employer is eligible and registers then the payments must be passed onto their eligible employees. Businesses must register for the benefit: Only businesses that register for JobKeeper payments will be eligible. If the business doesn't register then they won't receive any payments irrespective of how much their turnover has been impacted by the coronavirus crisis. Businesses can register via this link - https://www.ato.gov.au/general/gen/JobKeeper-payment/. The business will need to declare the impact on their turnover as well as all employees who are eligible for the payment. This will likely need to be updated monthly. Which employees are eligible? Any employee of the business as at 1 March 2020 is eligible if they continue to be employed or continue to be engaged by the business. This includes full time, part time and casuals (provided that the casual was employed by that business for at least 12 months as at 1 March 2020). Employees who've been stood down are considered to be eligible but those made redundant are not eligible unless they've subsequently been rehired (and were employed at 1 March 2020). Employees who work for more than 1 employer can only claim the benefit once. The indication is that they'll be able to claim from their "primary employer", which is the employer from whom they claim the tax-free threshold. Employee earnings: All eligible employees from all eligible registered businesses will receive the JobKeeper payment. The benefit is intended to replace lost income for those who've been stood down, those who've have had their income reduced significantly and/or to provide a subsidy to employers to help them pay employees. If an employee's current gross income is more than $1,500/fortnight then their employer need only pay the difference between the $1,500/fortnight JobKeeper payment and the employee's wage. If an employee's current gross income is less than $1,500/fortnight (including those currently receiving no income) then they'll receive the full $1,500/fortnight benefit (even if that's more than they would otherwise normally receive). Impact on superannuation, tax and social security: The JobKeeper payments won't be eligible for superannuation contributions. The JobKeeper payments will be treated as taxable income. The JobKeeper payments will also be assessable income for Centrelink purposes (please refer below). Can an employee receive the JobKeeper payment and also make a claim for the JobSeeker allowance? Please note that the JobSeeker allowance was formally known as Newstart and those of a certain age would know it as "the dole". It's important to note that the JobKeeper payment is assessable income in Centrelink's eyes and those receiving it must report that income to Centrelink. The current cut off point for JobSeeker eligibility is $1,086.50 per fortnight (for a single person with no dependants). Hence, those receiving the JobKeeper payment won't be eligible for the JobSeeker allowance as their income will be too high. What should you (or anyone you know) do if they're currently financially impacted? As JobKeeper payments are only paid to registered businesses, it's suggested that those impacted by the crisis contact their employer to check if the employer qualifies and if they intend to register. If their employer won't register or is unable to register for any reason then it's best to revert to the assistance available to individuals and families (please refer to the attached). An important enhancement for those seeking the JobSeeker allowance: Typically those applying for a JobSeeker benefit need to meet an income test and an assets test. The government has already announced a temporary lifting of the assets test in response to the crisis but has now also introduced a more lenient (and sensible) treatment of income earned by the partner of someone seeking a JobSeeker allowance. Previously if the partner of an applicant for the JobSeeker allowance earned more than $48,000 pa then the claim would be rejected. That threshold has now been lifted to $79,762 pa. The purpose of this is to capture some of those whose income has diminished or completely disappeared due to the crisis but who would otherwise have been precluded from support because of their partner's income. Next steps: Please contact our office if any further information is needed and we'll respond ASAP. Download File stimulus_package_-_assistance_for_individuals___households__1_.pdf Download File stimulus_package_-_assistance_for_small_and_medium_businesses__1_.pdf Sadly it seems that barely an hour goes by without further distressing news about COVID-19.

You will no doubt have seen the Australian government's response announced yesterday. Given the breadth of the measures we've summarised them into the attached documents - one specific to individuals & households and the other specific to small and medium businesses. The measures are intended to provide support to those requiring it, while also encouraging businesses to continue trading and, where able, to invest in capital and staff. These initiatives build on those announced on 12 March 2020 but it's highly unlikely that they'll be the last of the stimulus measures. We'll keep you informed, but the key takeaways from the current measures are: For individuals & households

For small and medium businesses

The intent of all measures is to minimise the financial burden on those in need and to also boost the economy as much as possible. We've already been contacted by many clients seeking assistance and we encourage anyone who's in need of advice to please be in touch. Some of the announced measures will apply automatically to those who are eligible, but if you're unsure or need clarity then please let us know. Likewise we'll do our best to continue to communicate the economic and financial fallout from the crisis, but if you need more information about the specific impact on your financial position then please contact us. As always please take whatever precautions you feel are necessary to look after your health. The government is taking increasingly stringent steps to manage the spread of the virus and it's likely that these will increase in the coming days, weeks and months. In line with that we've made the decision that all staff of Next Level Financial Services will work remotely for the foreseeable future. This means that our offices will be closed, however we have the resources to work from our homes and will be contactable as normal. However, please note that if calling our office line - 03 9188 4254 - it's likely that you'll go through to our voicemail service. Please leave a message and we'll respond ASAP. We'll also be contacting clients with whom we had scheduled face to face meeting to make other arrangements. However, it's very much business as usual aside from our physical absence from the office. Download File stimulus_package_-_assistance_for_small_and_medium_businesses.pdf Download File stimulus_package_-_assistance_for_individuals___households.pdf |

AuthorNext Level Financial Services provides financial information in an easy to read format. Archives

August 2023

Categories

All

|

Our Financial Services Guide Privacy Policy (2020) Complaints ©2023 Next Level Financial Services CALL - 03 9188 4254

RSS Feed

RSS Feed