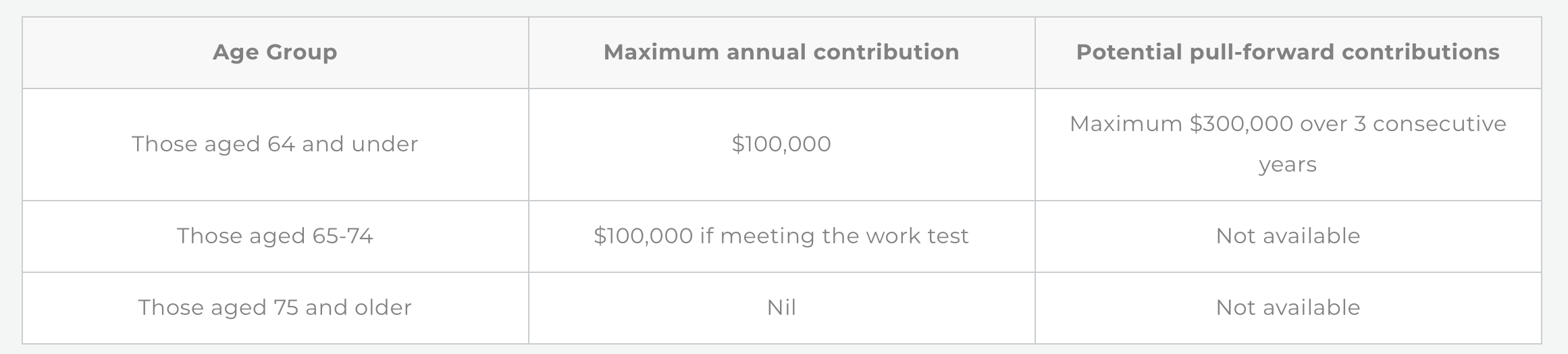

After-tax contributions to superannuation can now be made up to age 67 and the legislation was partially implemented on 1 July 2020. Background: The change in legislation pertains to after-tax contributions to superannuation – these are amounts that can be contributed to superannuation tax-free from accumulated savings, sale of assets etc. It doesn’t include employer contributions, salary sacrifice or tax deductible contributions, all of which are taxed when they reach your superannuation fund. Prior to 30 June 2020 the rules that pertained to after-tax contributions were: Those aged 64 and under could make after-tax contributions of up to $100,000 pa or up to $300,000 over 3 consecutive financial years. The latter refers to a ‘pull forward’ rule allowing the contributor to make a contribution of more than $100,000 in a financial year but then limiting the contributions that they can make over the next 2 financial years to an aggregate amount of no more than $300,000 over 3 consecutive years. For example, if the contributor used the pull forward rule to contribute $250,000 to superannuation in one financial year then they’d be limited to a maximum of $50,000 in additional after-tax contributions over the next 2 financial years. Those aged 65-74 could make post-tax contributions of up to $100,000 pa but only if they met the work test. The work test requires the contributor to have been gainfully employed for a minimum of 40 hours in any consecutive 30 day period in the year in which the contribution is made. Those in this age bracket were limited to after-tax contributions of $100,000 pa (ie: they can’t use the pull forward rule). What changes apply from 1 July 2020?

Hence, from 1 July 2020 the rules pertaining to after-tax contributions are: Age Group Maximum annual contribution Potential pull-forward contributions Those aged 66 and under $100,000 Maximum $300,000 over 3 consecutive years* Those aged 67-74 $100,000 if meeting the work testNot available Those aged 75 and olderNilNot available * Assuming that the legislation to permit those aged 65 and 66 to utilise the pull forward rule passes parliament. Please note:

What impact does this have on your financial plan? The change in regulations provides further flexibility over coming years to ensure individuals have the maximum possible funds within a tax-free environment at retirement. The main advantage will be the extension to the period of time that everyone will be able to get funds into superannuation even if they are not working past age 65. For more information book a complimentary initial appointment with our team. This information is issued by Next Level Financial Services ABN 40 771 964 301, Corporate Authorised Representative No. 461059 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 (AFSL 225051) and is current as at the date of publication. It is not financial product advice and is intended as a guide only. In preparing this information, Next Level Financial Services has relied on publicly available information and sources believed to be reliable. However, the information has not been independently verified by Next Level Financial Services. While due care and attention has been exercised in the preparation of this information, Next Level Financial Services gives no representation or warranty (express or implied) as to its accuracy, completeness or reliability. The information presented is not intended to be a complete statement or summary of the matters referred to. Neither Next Level Financial Services nor their related entities, nor any of their directors, employees or agents accept any liability for any loss or damage arising out of the use of all or part, or any omission, inadequacy or inaccuracy in, the information presented. Comments are closed.

|

AuthorNext Level Financial Services provides financial information in an easy to read format. Archives

May 2024

Categories

All

|

Our Financial Services Guide Privacy Policy (2020) Complaints ©2023 Next Level Financial Services CALL - 03 9188 4254

RSS Feed

RSS Feed