|

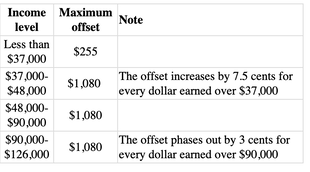

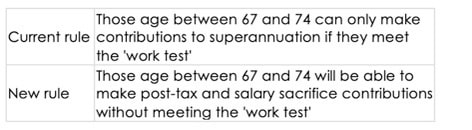

The 2021/22 budget was handed down by federal government last night. As was the case with the delayed (COVID) 2020/21 budget, the focus is expansionary to pump money into the economy. Below is an overview of the key issues that we expect will most impact financial plans and strategy in the future. This isn't a complete list of all the initiatives that were announced so if you require further detail on the information below or on any other matters from the budget announcement then please contact our office and we'll be very happy to provide that detail. The key initiatives are: Personal taxation: Low and Middle Income Tax Offset (LMITO): This offset was introduced for the current tax year and will be carried over to the 2022 financial year as well (ie: to 30 June 2022). The offset reduces the tax liability of those in the above income brackets but isn't a refundable amount if the individual's tax liability is zero. Medicare levy: Effective immediately the Medicare levy low-income thresholds for singles, families, seniors and pensioners is to be increased so that such taxpayers generally continue to be exempt from paying the levy. The income threshold to be exempt from the levy increases to $39,167 for families (potentially more for dependent children or students) and to $51,094 for seniors and pensioner families. Superannuation: Repealing the work test (effective 1 July 2022): The above is only relevant to those aged in the 67-74 age bracket who don't meet the work test. Contribution cap limits will still apply - we'll send a separate communication on this shortly as limits are changing from 1 July 2021.

Extending the downsizer contribution: From 1 July 2022 those aged 60 or older will be able to make contributions to superannuation from the sale of their home (subject to conditions being met). The current age limit is 65 or older. Opportunity to exit from some 'legacy' superannuation pension products: There are some 'legacy' superannuation pension products in the market, the most common of which are term allocated pensions, that were introduced for specific purposes (eg: to be more Centrelink friendly). The difficulty with such products is that they're inflexible and those who took them up have become 'stuck' with them. However effective from the 1 July after the passing of legislation, holders of these legacy products will have 2 years in which to transfer them to more flexible products. This will only impact a relatively small number of people and we'll be in touch with you should the initiative provide you with any benefits. Abolition of the $450/month income threshold: Currently, employers aren't required to make superannuation contributions for employees earning less than $450/mth. From 1 July 2022, superannuation must be paid to all employees irrespective of their income level. This initiative is separate to the planned increase in the employer superannuation guarantee level, which will be effective from 1 July 2021. We'll communicate this separately. Families and social security: Pension Loan Scheme: From 1 July 2022 the Pension Loan Scheme (which enables those receiving the Centrelink age pension to access loan payments from Centrelink) will be made more flexible to permit borrowers to access up to 2 lump sum advances. Child Care Subsidy: From 1 July 2022 a higher level of CCS will be paid to families with more than one child under age 6 in child care. The level of subsidy will increase by an extra 30% to a maximum subsidy of 95% for the second and subsequent children. Caps will also be removed for families on higher income levels. Aged care: In response to the recent Aged Care Royal Commission, the Government will deliver a $17.7 billion package of support to the sector over 5 years. Funding will focus on home care as well as the sustainability, quality and safety of residential care. Two immediate impacts will be the release of 80,000 new home care packages over two years from 2021-22 and a commitment by the Government to improve daily living conditions in residential care by contributing $10 per day for each resident on top of the basic daily fee. No mention was made in the budget of any changes to means tests or out of pocket costs. The proposed Aged Care Act is expected to address those issues. In summary: While this budget isn't as expansionary as last year's, the government is predicting that it will be several years before we see a surplus and the cost of ongoing deficits is increasing. The government is currently able to borrow at very low rates of interest, which minimises the impact on the bottom line, however with the possibility of a Federal election later this year it's expected that this will become a political issue. Successive governments have focussed heavily on budget surpluses, but COVID seems to have altered that thinking. How long this lasts remains to be seen. Also of note is the potential for expansionary budget measures to cause inflation. This isn't of significant concern at this stage and the RBA has been clear that they don't expect rates to increase in the near future, but if the government's optimistic expectations of future unemployment prove to be accurate then it's expected that inflation pressures will build. We'll communicate over the coming weeks on some of the key issues above that will impact you, but in the meantime please contact our office for any further information required. This information is issued by Next Level Financial Services ABN 40 771 964 301, Corporate Authorised Representative No. 461059 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 (AFSL 225051) and is current as at the date of publication. It is not financial product advice and is intended as a guide only. In preparing this information, Next Level Financial Services has relied on publicly available information and sources believed to be reliable. However, the information has not been independently verified by Next Level Financial Services. While due care and attention has been exercised in the preparation of this information, Next Level Financial Services gives no representation or warranty (express or implied) as to its accuracy, completeness or reliability. The information presented is not intended to be a complete statement or summary of the matters referred to. Neither Next Level Financial Services nor their related entities, nor any of their directors, employees or agents accept any liability for any loss or damage arising out of the use of all or part, or any omission, inadequacy or inaccuracy in, the information presented. Comments are closed.

|

AuthorNext Level Financial Services provides financial information in an easy to read format. Archives

May 2024

Categories

All

|

Our Financial Services Guide Privacy Policy (2020) Complaints ©2023 Next Level Financial Services CALL - 03 9188 4254

RSS Feed

RSS Feed