|

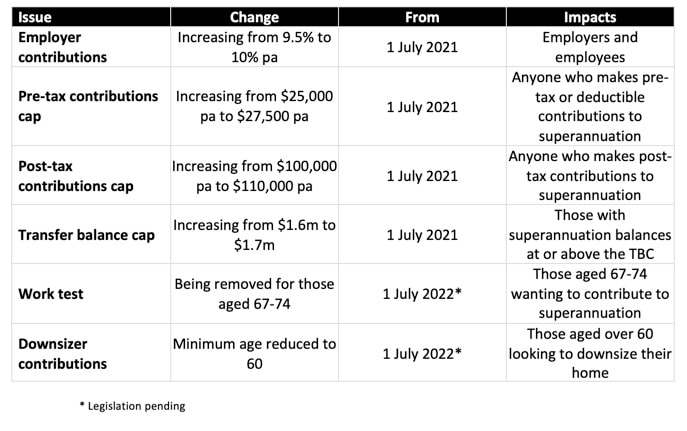

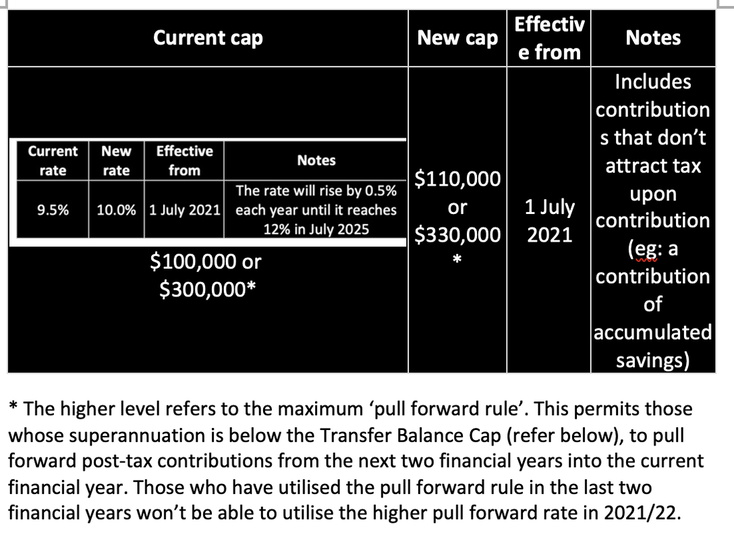

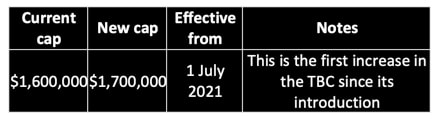

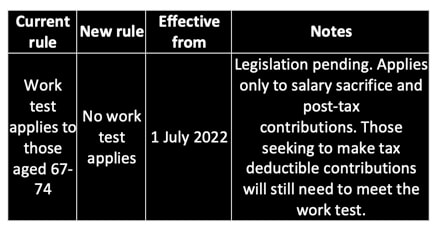

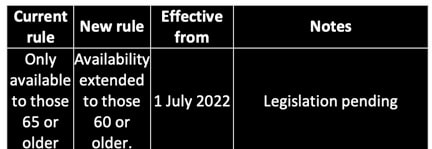

There are some important changes to superannuation regulations that will be rolled out over the next 12 months. Some of these have been expected for some time and others were announced in last month’s federal budget. We’ll discuss the changes that will have an impact on your financial plan directly and through the normal review process to ensure that you’re taking advantage of the opportunities that are relevant to you, however as it’s difficult to keep track of all changes we’ve summarised the key issues and impacts below. As always, please contact me with any queries or for more information. The table provides a high level summary with more detail below:  Employer contributions: From 1 July 2021 employer contributions (known as superannuation guarantee contributions – SGC) will increase from 9.5% of base salary to 10.0%. The above increase has been debated for several years with the current government seemingly reluctant to apply the increase, although they used the recent federal budget to confirm it. What impact will this have on employee’s gross salary? It depends. If an employee’s contract is for a base rate of pay plus superannuation then their gross salary (and take home pay) should be the same while their superannuation contribution should increase by 0.5% from 1 July 2021. However, if their contract is for a total level of remuneration including superannuation then they may receive a lower level of gross salary/take home pay. For example, if the employee’s contract states a base income of $100,000 plus superannuation then their gross salary/take home pay should remain the same from July with their annual employer superannuation contribution increasing from $9,500 to $10,000. However, if their contract states a remuneration package of $100,000 inclusive of superannuation, then their gross salary (net of superannuation) may decrease from $91,324 (plus 9.5% superannuation = $100,000) to $90,909 (plus 10% superannuation = $100,000). If in doubt it’s best to speak with your employer to determine any potential impact on your take home salary. Pre-tax contributions: The cap on pre-tax contributions will increase from $25,000 to $27,500. Those who are currently contributing at or close to the cap may choose to increase their salary sacrifice or deductible contribution rate to take account of the increase. Catch up increases (for those with superannuation balances below $500,000 who haven’t utilised the full cap in prior financial years, since 2018/19) remain in place. Post-tax contributions: The cap on post-tax contributions will increase from $100,000 pa to $110,000 pa (and from $300,000 to $330,000 for those utilising the pull forward rule). Transfer balance cap (TBC): The transfer balance cap is the maximum balance that an individual can transfer to a superannuation pension upon retirement. The increase in cap may enable some who’ve previously transferred funds to a superannuation pension account to add to that balance. Removal of the work test: The work test applies to those aged 67-74. It means that those in that age bracket seeking to contribute funds to superannuation need to have been gainfully employed for a minimum of 40 hours in any consecutive 30 day period in which the contribution is made. If they don’t meet the work test then they can’t contribute to superannuation. The change will only apply to salary sacrifice and post-tax contributions inclusive of the pull forward rule (which is currently only available to those under 65). Downsizer contributions: The downsizer contribution regulation permits those aged 65 or older to contribute up to $300,000 to superannuation ($600,000 for a couple) from the sale of their home. Various conditions apply including the requirement that the home have been owned for at least 10 years. From 1 July 2022 the minimum age for eligibility will decrease to 60, enabling more to take advantage of the opportunity.

Downsizer contributions don’t count towards the superannuation cap limits and can be made even if an individual has already reached their transfer balance cap. Other key changes: --> From 1 July 2022 employers need to make superannuation contributions for all staff irrespective of their income level (currently those earning less than $450/month aren’t eligible for superannuation contributions). --> From 1 July 2022 those who are invested in a number of ‘legacy’ superannuation products will have a two-year window to move to other products. The most common of these ‘legacy’ products is the superannuation term allocated pension (TAP), which has a favourable Centrelink treatment but is inflexible in many of its features. This information is issued by Next Level Financial Services ABN 40 771 964 301, Corporate Authorised Representative No. 461059 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 (AFSL 225051) and is current as at the date of publication. It is not financial product advice and is intended as a guide only. In preparing this information, Next Level Financial Services has relied on publicly available information and sources believed to be reliable. However, the information has not been independently verified by Next Level Financial Services. While due care and attention has been exercised in the preparation of this information, Next Level Financial Services gives no representation or warranty (express or implied) as to its accuracy, completeness or reliability. The information presented is not intended to be a complete statement or summary of the matters referred to. Neither Next Level Financial Services nor their related entities, nor any of their directors, employees or agents accept any liability for any loss or damage arising out of the use of all or part, or any omission, inadequacy or inaccuracy in, the information presented. Comments are closed.

|

AuthorNext Level Financial Services provides financial information in an easy to read format. Archives

May 2024

Categories

All

|

Our Financial Services Guide Privacy Policy (2020) Complaints ©2023 Next Level Financial Services CALL - 03 9188 4254

RSS Feed

RSS Feed